The Tower Top is one of those powerful but often overlooked candlestick patterns that can help traders spot a potential trend reversal before the market turns against them. Visually, it resembles a tower built at the top of an uptrend — and just like a real tower, it can come crashing down fast.

In trading, the earlier you identify the top, the better your chances of protecting profits or entering a high-probability short.

Let’s break it down simply and clearly.

What Is the Tower Top Pattern?

The Tower Top is a bearish reversal pattern seen in candlestick charts. It usually signals the end of a bullish trend and the beginning of a downward move. It gets its name from the formation itself — a structure that looks like a “tower” standing at the top of the trend.

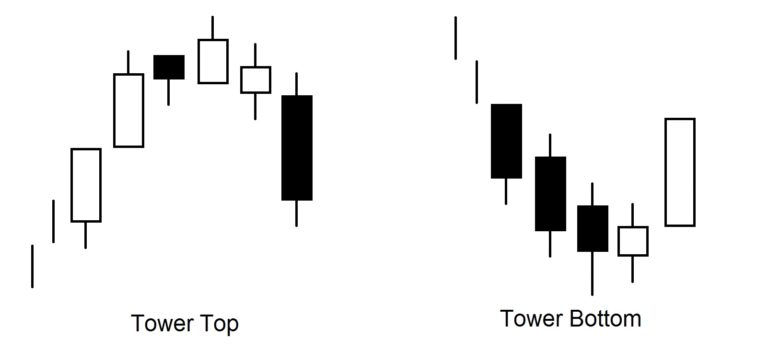

This pattern is composed of:

- A strong bullish move made up of long green candles (the left wall),

- Followed by a few short candles at the peak (the top of the tower),

- And then a sharp bearish decline marked by long red candles (the right wall).

The result? A structure resembling a tall tower, often indicating that bulls have run out of steam, and a reversal or significant correction is near.

Conditions for Formation

For the Tower Top to be valid, several specific conditions must be met:

- A Clear Uptrend The pattern only makes sense after a sustained bullish trend.

- Strong Green Candles One or more long bullish candles must appear, forming the left “wall” of the tower.

- Short Candles at the Top Around 2 to 4 small-bodied candles (green, red, or mixed) appear at the peak — showing indecision or slowing momentum.

- A Strong Bearish Move The pattern completes with a long red candle (or a series of them), forming the right “wall” and taking the price back to the previous base or support level.

Why Is the Tower Top Important?

This pattern is particularly useful for identifying exhaustion in bullish momentum. If you’re holding a long position, this can be your early exit signal. If you’re looking for a short, this can serve as your entry confirmation.

Patience in recognizing these formations can make the difference between catching a trend and being caught by it.

Entry Strategy

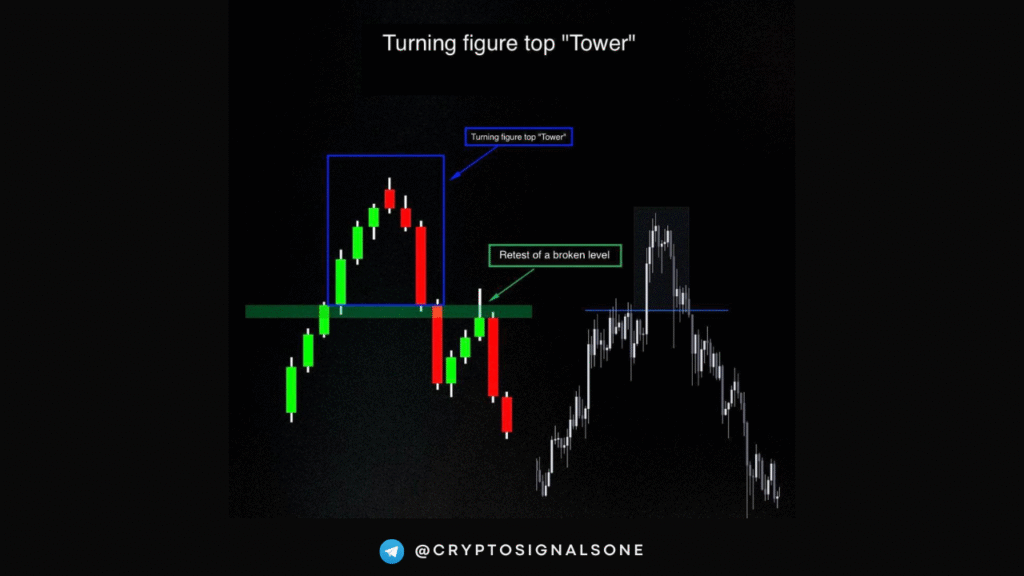

Once the final bearish candle forms and breaks the support level (the base of the pattern), traders often look for:

- A pullback (retest) to the broken level as confirmation.

- Entering short positions once the retest fails and bearish momentum resumes.

As shown in the chart, the price retested the broken support zone, failed to reclaim it, and then continued dropping — a classic setup for a profitable short trade.

How to Use Volume with the Tower Top Pattern

This section explains how volume analysis can confirm the pattern’s reliability:

- Rising volume during the uptrend

- Falling volume during the top (indecision)

- Spike in bearish volume during breakdown

This helps traders avoid false signals and time better entries.

Key Takeaways

✅ The Tower Top signals a shift from bullish to bearish.

✅ It is composed of long green candles, followed by short candles at the top, and then long red candles.

✅ The breakdown of the base and a failed retest provide a clear short signal.

✅ Combining this pattern with volume and trendline breaks can increase accuracy.

Final Thoughts: Trust the Patterns, Back Them With Logic

The Tower Top may look simple, but when you combine it with volume, structure, and price action, it becomes a powerful tool in your trading arsenal.

You don’t need 20 indicators to spot trend reversals. You need clarity, structure, and confidence.

Trade smart. Spot the tower. And don’t wait for it to fall on you.

Join my community of crypto enthusiasts and serious traders!

1️⃣ Join our Telegram Channel ️

2️⃣ Learn more about our signals and strategies

3️⃣ Join our Private Email list & Get Access to our Trading Signals

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Always conduct your own research before making any trading decisions.

This article does not contain any affiliate links. The page referenced is simply my personal page where you can enter your email if you are genuinely interested in learning more about trading.

![Dogecoin: First Meme Coin ETF on the Horizon – Is It Time to Buy? [Analysis]](https://cryptosignals.one/wp-content/uploads/2025/09/a-vibrant-cartoon-illustration-depicting_stzRCQN_SQOWd_7E3CxL2A_YRk3wyqaS-uLn0m08PiFvg.jpeg)