How to analyze price action and spot confirmation-based entries using multi-timeframe zones of interest

Understanding the Market Structure: A Bullish Scenario in Development

🔥 What Is Smart Money Concepts (SMC) in Trading?

Smart Money Concepts (SMC) is a trading methodology used by professional traders and institutions to analyze market structure, liquidity, and price movements. Unlike retail trading strategies, SMC focuses on institutional order flow, identifying key levels where “smart money”—banks and hedge funds—enter and exit positions.

✅ Key Elements of SMC:

- Order Blocks – Areas where institutions place large trades, creating strong support/resistance levels.

- Fair Value Gaps (FVG) – Imbalances in price action that indicate liquidity zones.

- Break of Structure (BOS) – Confirmation of trend shifts when key price levels are broken.

- Liquidity Hunts – Manipulation points where smart money triggers stop losses before reversing.

📈 Why Traders Use SMC?

SMC allows traders to spot institutional movements, avoid retail traps, and enter the market with higher precision and confidence. It’s widely used in Forex, Crypto, and Stocks to enhance trading accuracy. 🚀

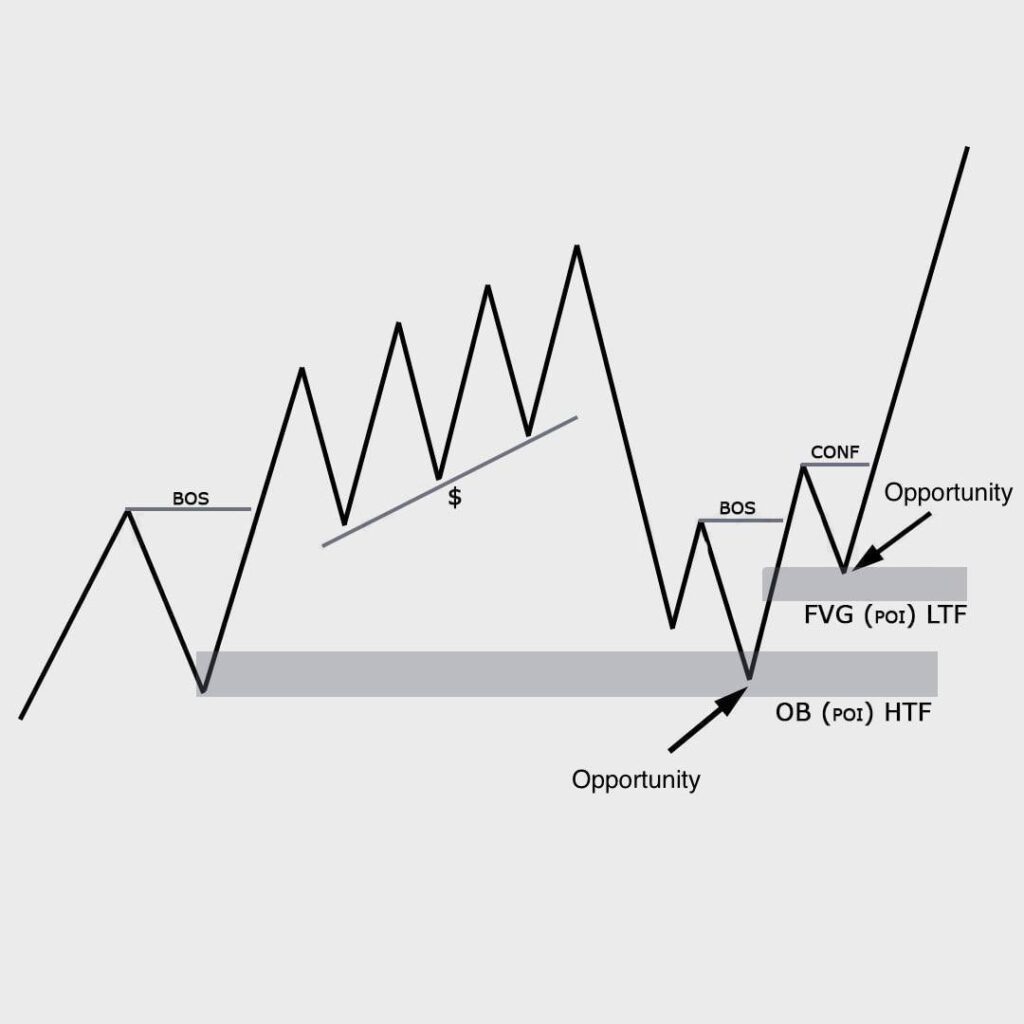

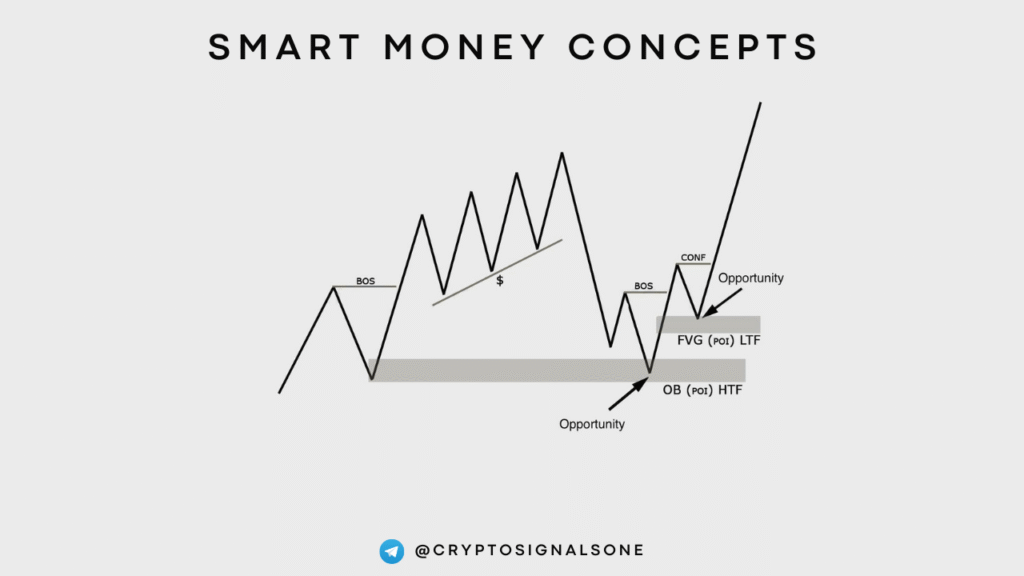

Before we talk about entries, it’s essential to understand the structure that leads to opportunity. In this scenario, the market begins with a strong bullish structure, printing a series of higher highs (HH) and higher lows (HL).

Each impulsive wave to the upside indicates aggressive buying, and each correction forms liquidity pools below the swing lows. These liquidity pools are key: they tell us where the “uninformed” stop losses are sitting — and where smart money may strike next.

What signals a slowdown in bullish momentum?

Toward the top of the structure, we notice a loss of momentum. Price starts to compress, forming smaller swing highs. This compression is not a random pause — it’s the market preparing for a deeper correction. This stage often traps late buyers before a controlled drop into a demand zone.

Price rarely moves randomly — it often seeks liquidity before continuing in the original direction.

The First Opportunity: Order Block on the Higher Timeframe (HTF)

Why higher timeframe POIs matter

As price dumps and breaks the local bullish structure, it heads directly into a higher timeframe Order Block (OB). Order blocks are the last down candle (or series of candles) before a significant move up. In Smart Money Concepts, they are often used as zones of accumulation or mitigation.

In this case, the higher timeframe OB acts as a point of interest (POI). Price taps into this zone, and here lies the first trade opportunity — an aggressive entry for those experienced in anticipating reaction-based trades.

Key notes:

- This is a counter-correction entry but in the direction of the overall trend.

- No confirmation is required for aggressive traders, but risk management is essential.

Liquidity Grab and BOS on Lower Timeframe (LTF)

After the reaction from the HTF OB, the price begins to shift. But how do we know the correction is truly over?

The power of Break of Structure (BOS)

Price breaks above a lower high, marking a Break of Structure (BOS) on the lower timeframe. This is crucial: it confirms that the downward correction is ending and buyers are regaining control. This BOS often follows a liquidity sweep, grabbing stop losses below a previous low.

Confirmation isn’t optional for many traders — it’s a signal of probability aligning in your favor.

This BOS offers a more conservative signal than the first opportunity, as it’s based on structure and not just reaction.

The Second Opportunity: LTF Fair Value Gap (FVG) + Confirmation

Fair Value Gap (FVG) and why it matters

After the BOS, price retraces into a Fair Value Gap (FVG) — a price imbalance where institutional orders have likely left unfilled trades. This area becomes a LTF POI (Point of Interest) for the second trade.

This time, price:

- Broke structure upward.

- Retraced into the imbalance (FVG).

- Reacted with confirmation (CONF) — another bullish sign.

This forms the second trade opportunity, which is:

- More conservative and backed by multiple confirmations.

- Ideal for traders who want to limit risk and avoid early entries.

Quick Tip:

FVGs are commonly used by smart money to re-enter positions — especially when they align with BOS and OB zones.

Final Structure Development: Letting the Trade Play Out

After the second entry, price resumes its bullish movement, continuing the larger uptrend. At this point, there are no new positions to take — it’s all about trade management and letting the market unfold.

Exit strategies depend on structure

You can consider scaling out at:

- The previous high (for conservative targets)

- The next major liquidity pool above (for extended targets)

- A new OB or FVG formation on the higher timeframe

Patience is the trader’s edge. Enter with logic. Exit with discipline.

Summary: Key Lessons from This SMC-Based Setup

This single price sequence demonstrates multiple Smart Money Concepts in motion:

- Liquidity engineering through compression and sweep

- Higher Timeframe Order Block (HTF OB) as an early entry zone

- Break of Structure (BOS) as confirmation

- Fair Value Gap (FVG) as a second entry point

- Multi-timeframe confluence as the cornerstone of precise trading

By mastering these concepts, you can move away from emotional trades and focus on structure, logic, and timing.

🚀 Recommended Exchange (Bybit review)

Join my community of crypto enthusiasts and serious traders!

1️⃣ Join our Telegram Channel

️2️⃣ Learn more about our signals and strategies

3️⃣ Join our Private Email list & Get Access to our Trading Signals

![Dogecoin: First Meme Coin ETF on the Horizon – Is It Time to Buy? [Analysis]](https://cryptosignals.one/wp-content/uploads/2025/09/a-vibrant-cartoon-illustration-depicting_stzRCQN_SQOWd_7E3CxL2A_YRk3wyqaS-uLn0m08PiFvg.jpeg)