Why the $105K level could act as a springboard—or a trap—before Bitcoin’s next move.

Bitcoin Smashes Past Previous Records, Sets the Stage for New Highs

Bitcoin surged to new heights this week, crossing the historic $112,000 mark and firmly establishing support above the psychologically important $100,000 level.

After a prolonged period of consolidation and gradual gains, this breakout signals a clear shift in market dynamics—bulls have taken the reins.

Optimism has spread rapidly across the crypto landscape as BTC enters uncharted territory, sparking renewed excitement and confidence among investors.

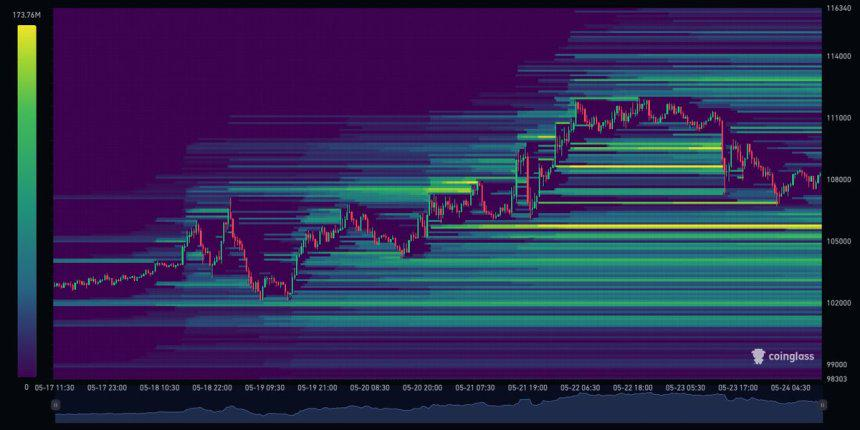

But this wasn’t just a breakout on the charts—it was underpinned by solid positioning in the derivatives space. Insights from Coinglass highlight a dense concentration of liquidation levels around $105,700.

This could act as a short-term liquidity target, potentially drawing price action in for a quick dip before the upward trend resumes.

The overall setup continues to lean bullish. As long as Bitcoin maintains closes above $100K and avoids deeper pullbacks, the market’s path seems tilted upward.

With strong momentum, favorable technicals, and bullish macro signals converging, the weeks ahead may prove pivotal—not just for BTC, but for the entire crypto market as a new bullish cycle potentially unfolds.

BTC Shows Resilience in a Tough Macro Landscape

Despite global economic uncertainty and rising pressure from elevated US Treasury yields, Bitcoin remains strong—closing out another bullish week with a new peak at $112,000. Even after a modest pullback, it’s holding ground above $100K, showing remarkable resilience in contrast to the broader market, where many altcoins remain far from their previous highs.

The cautious tone in investor sentiment hasn’t turned to full-on euphoria yet, but confidence in BTC’s role as a safe-haven asset is growing.

In an environment where risk aversion is high, Bitcoin is proving to be a standout performer—further cementing its position as a reliable store of value when traditional markets get shaky.

Adding to this analysis, crypto market expert Ted Pillows drew attention to liquidity data from Coinglass that pinpoints a significant cluster at the $105,700 level.

According to Pillows, this zone could act like a magnet in the near term, possibly triggering a brief stop-loss sweep before the uptrend reasserts itself.

Thick Liquidity at $105K Could Trigger Short-Term Shakeout

“The liquidity around $105K is heavy,” one analyst observed, noting that a quick move into this area could flush out overly aggressive long positions before Bitcoin resumes its climb. While the broader setup remains bullish, the possibility of short-term volatility cannot be ruled out.

If BTC manages to defend the $100K to $105K support band and reclaims the $110K level, a fresh rally to new highs could arrive sooner than anticipated.

Bulls currently hold the advantage, but caution persists as macro uncertainty continues to shadow global markets.

Technical Structure Remains Intact Above Key Averages

Bitcoin is trading near $108,249 on the 4-hour chart after touching $112,000 earlier in the week.

The price is consolidating above a cluster of crucial moving averages: the 34 EMA at $108,046, the 50 SMA at $106,840, and the 100 SMA at $105,109. All are trending upward and acting as strong dynamic support.

As long as BTC holds above these key levels, the short-term structure remains favorable for further upside momentum.

Market Calm Before the Next Surge?

Despite the sharp rejection near $112K, Bitcoin hasn’t shown signs of weakness — no major liquidation events, no panic-driven pullbacks.

Instead, price is holding a mid-range structure, suggesting healthy consolidation. The $103,600 level, once a stubborn resistance, now flips into key horizontal support.

This zone may act as a defensive wall if sellers try to push lower.

Volume has declined on the pullback, a classic sign of corrective, not impulsive, behavior. Sellers appear cautious. The real question now is whether bulls can capitalize on this pause.

If BTC reclaims $110K with conviction and volume picks up, a move to sweep the highs could follow quickly.

But even if we get another dip first, as long as price respects $106K and closes above the short-term EMAs, the bias remains bullish.

New factor to watch? Open interest across derivatives markets continues to climb — a sign that positioning is building.

This could fuel volatility. Whether that move is triggered by a liquidity sweep below or a breakout above remains to be seen.

For now, all eyes remain on the compression forming just below $110K. In crypto, compression leads to expansion — and right now, bulls are still in the driver’s seat.

🚀 Recommended Exchange (Bybit review)

Join my community of crypto enthusiasts and serious traders!

1️⃣ Join our Telegram Channel

️2️⃣ Learn more about our signals and strategies

3️⃣ Join our Private Email list & Get Access to our Trading Signals