Why Dogecoin Matters Right Now

Dogecoin (DOGE) is entering one of its most crucial weeks in recent memory. Not only is the price sitting at a key level, but the market is buzzing over what could be the first-ever U.S. listed Meme Coin ETF.

At the time of writing, DOGE trades at $0.2160 USDT, almost unchanged on the week (+0.90%). August closed in similar fashion (+1.89%) after a stronger July (+27%). Year-to-date, however, the balance remains negative at –32%.

Dogecoin ETF Incoming?

The potential ETF, promoted by REX – Osprey (already behind a Solana product), could bring a wave of liquidity into Dogecoin. More importantly, it would serve as a test case for the meme coin sector, which has never seen a regulated financial instrument of this kind before.

The move has sparked debate: would an ETF finally give DOGE the institutional credibility it has lacked, or simply amplify its speculative nature?

Institutional Support: A $175M Dogecoin Treasury

Adding to the bullish narrative, CleanCore Solutions recently established a $175 million treasury dedicated to buying DOGE.

The initiative, backed by the Dogecoin Foundation, features Marco Margiotta as CIO and Alex Spiro, Elon Musk’s lawyer, as board president. This kind of structured support marks a shift: meme coins are no longer just internet jokes but assets with real financial infrastructures forming around them.

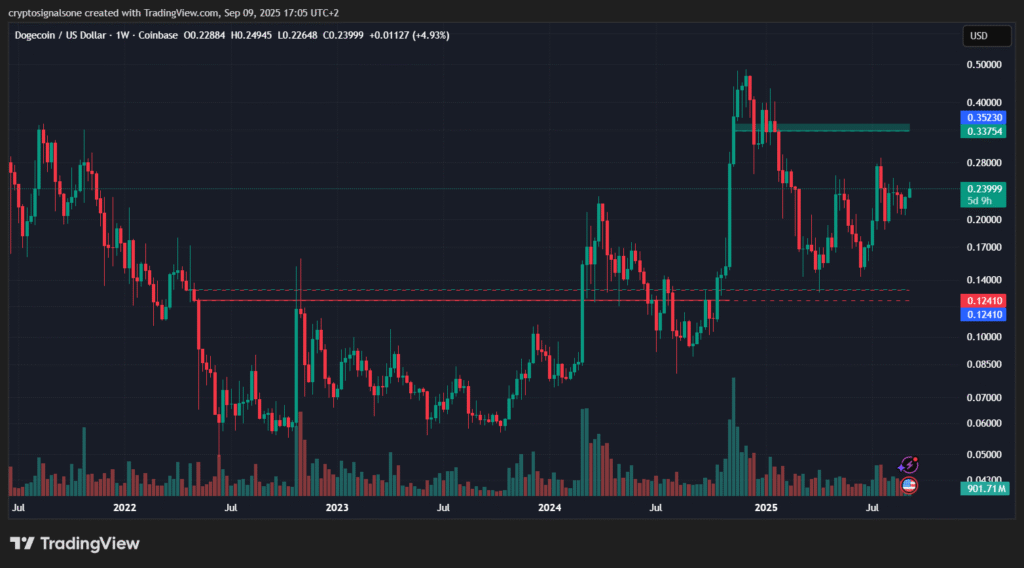

Weekly Chart: Dogecoin’s Wild Ride

Dogecoin’s weekly chart over the last year tells the story of massive swings:

- From the September 2024 low at $0.08893, DOGE rallied nearly +500%, peaking at $0.48434 within just three months.

- In 2025, a brutal drop followed, bottoming at $0.12986 in April, where a strong support zone at $0.14 formed.

- From there, DOGE rebounded toward $0.2650, only to face resistance and fall again.

- By late July, it reached $0.2875, but the key medium-term resistance remains at $0.3050 USDT.

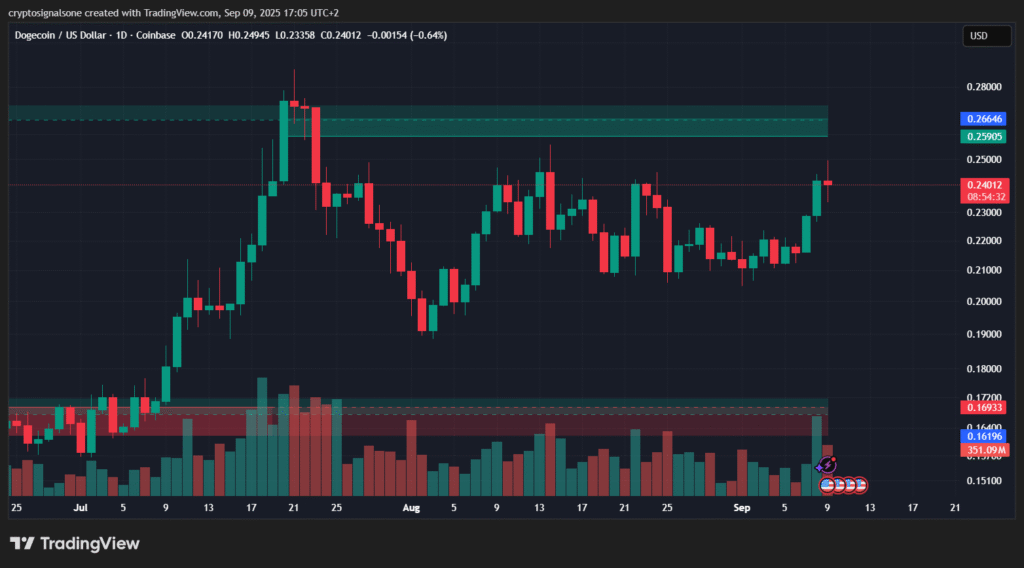

Current Market Setup: Range-Bound Dogecoin

Since August, Dogecoin has been stuck in a box range visible on the daily chart.

- Support: around $0.2050 USDT.

- Resistance: around $0.2470 USDT.

- The range has narrowed significantly, with recent moves compressing into just a 6% congestion zone.

Bollinger Bands are tightening, signaling a volatility breakout is approaching. Price also remains under the 50-day simple moving average (SMA50), making its recovery a key trigger for bullish momentum.

Key Levels to Watch

- $0.2050 USDT → short-term support.

- $0.2470 USDT → breakout resistance.

- $0.3050 USDT → medium-term resistance and signal for trend reversal.

The longer this congestion continues, the more explosive the breakout is likely to be—either upward or downward.

Final Thoughts: Is It Time to Buy Dogecoin?

Dogecoin is at a crossroads. On one hand, the ETF narrative and the creation of a $175M treasury could provide strong fundamental backing. On the other, DOGE remains heavily tied to overall crypto sentiment and meme culture volatility.

For traders, the setup is clear: the breakout from the current range will define the next big move. For long-term investors, the potential approval of a U.S. ETF could mark the start of Dogecoin’s transition from internet joke to mainstream financial product.

The question isn’t just “is it time to buy?” but rather: can Dogecoin finally prove it belongs in the institutional arena without losing its meme-driven identity?

Recommended Exchange (Bitunix review)

Trade on Bitunix for rewards and prizes

![Dogecoin: First Meme Coin ETF on the Horizon – Is It Time to Buy? [Analysis]](https://cryptosignals.one/wp-content/uploads/2025/09/a-vibrant-cartoon-illustration-depicting_stzRCQN_SQOWd_7E3CxL2A_YRk3wyqaS-uLn0m08PiFvg-1024x574.jpeg)